Comply with ARCA Regulations Without the Hassle

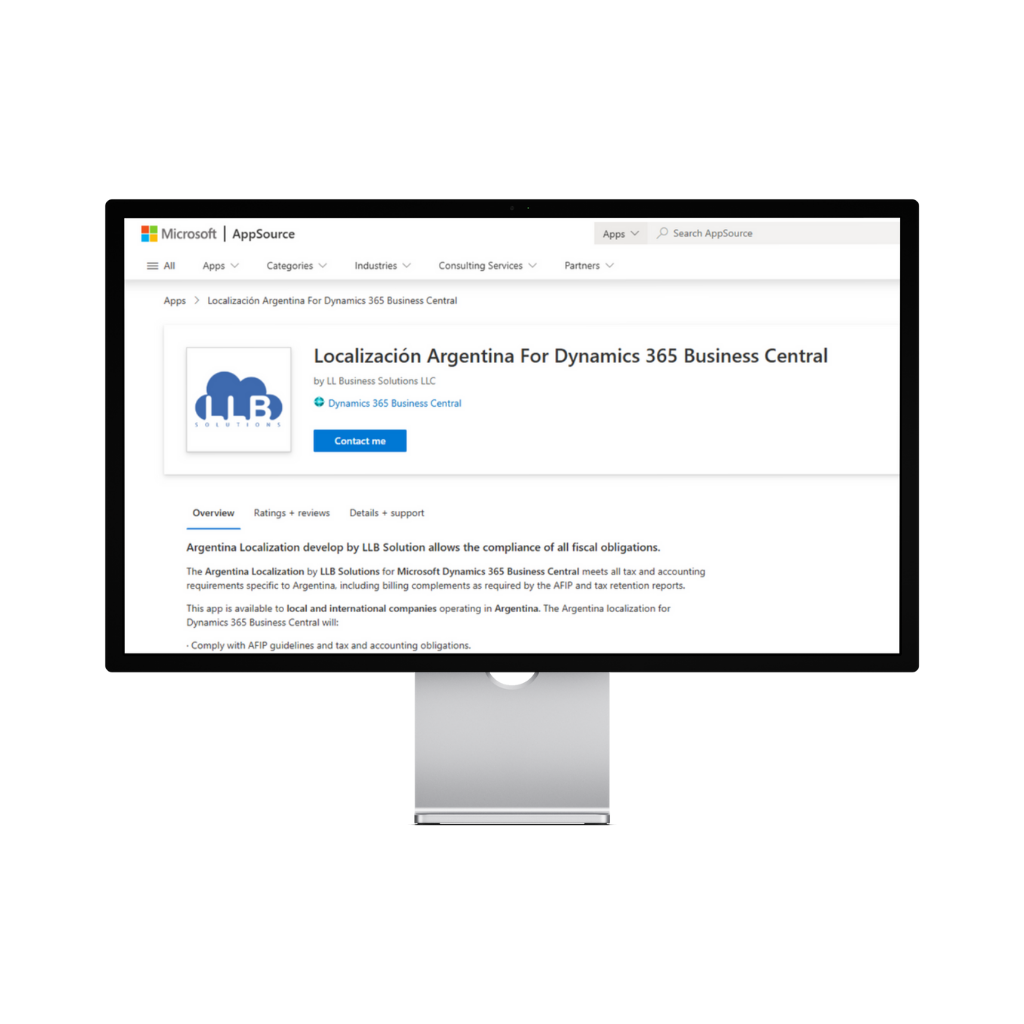

LLB Solutions offers a certified localization for Microsoft Dynamics 365 Business Central, specifically designed to meet the tax and fiscal requirements of the Agencia de Recaudación y Control Aduanero (ARCA) in Argentina. Our localization is available on Microsoft AppSource and ready for deployment without the need for additional development.

This localization extends the standard functionality of Business Central to facilitate regulatory compliance. It includes electronic invoicing, tax reports, VAT withholdings and perceptions, information regimes, imports and exports, and other obligations required by the ARCA.

In addition, it comes with built-in integration to an authorized electronic invoice provider, enabling a fast start and immediate compliance with the standards established in Argentina.

Español

Español

LLB Solutions is a leader in delivering robust solutions for Dynamics 365 Business Central. We create experiences and drive transformation.

LLB Solutions is a leader in delivering robust solutions for Dynamics 365 Business Central. We create experiences and drive transformation.