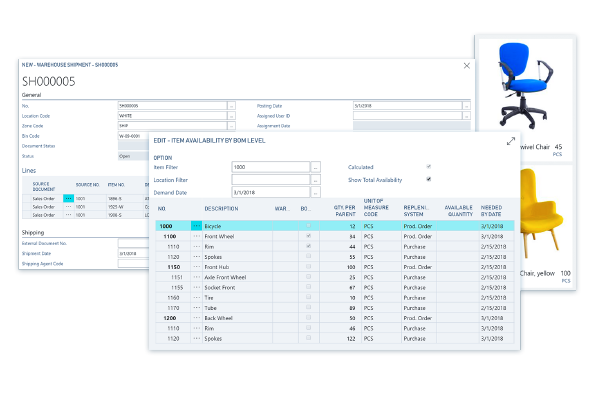

LLB Solutions has developed Microsoft Dynamics 365 Business Central localizations for Latin America. Our localization complies with all Honduran tax and accounting obligations and all specific laws and regulations, such as the complement of invoicing requested by the SAR and tax withholding and reporting.

Our localization of Microsoft Dynamics 365 Business Central Honduras, is the complement of the standard basic functionality of Microsoft Dynamics 365 Business Central with developments and functionalities that allows to comply with the specific laws and regulations requested by the SAR.

This localization application is available for local or international companies with economic activity in Honduras that will allow:

- Comply with SAR guidelines, tax and accounting obligation.

- Adaptation of accounting and tax functionality according to Honduran legislation.

- Access to functional, technical and localization training.

- Comprehensive training on best practices in Dynamics 365 Business Central. Continuous support during data migration and activation.

- Terminology adjustment according to the region in the different standard Dynamics modules.

Español

Español

LLB Solutions is a leader in providing robust software, web development and ERP & CRM business solutions. We create experiences and transformations.

LLB Solutions is a leader in providing robust software, web development and ERP & CRM business solutions. We create experiences and transformations.