LLB Solutions has developed Microsoft Dynamics 365 Business Central localizations for Latin America. Our localization complies with all Ecuadorian accounting, tax and fiscal obligations and all specific laws and regulations, required by SRI (Servicio de Rentas Internas) for tax withholding and reporting.

This localization application is available for local or international companies with economic activity in Ecuador.

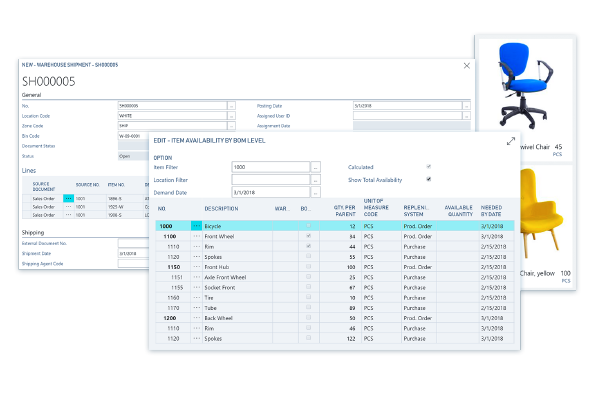

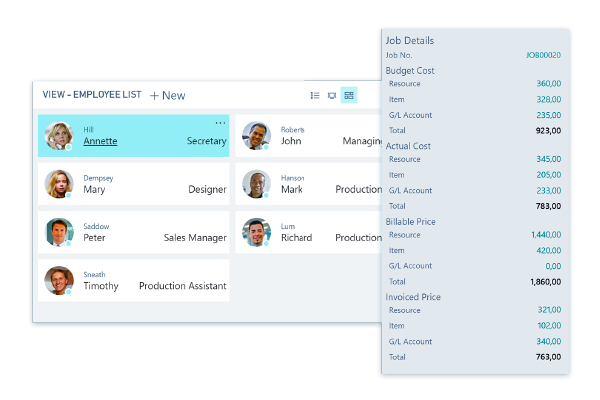

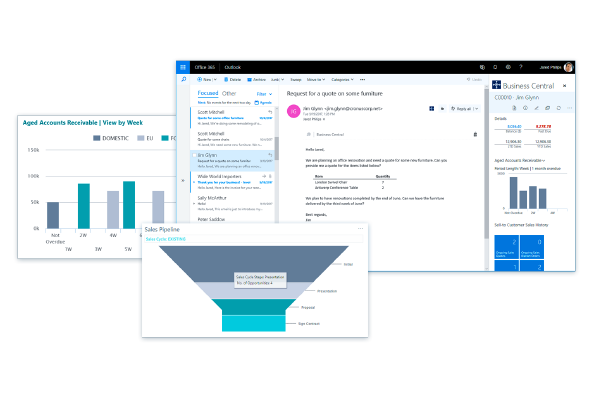

Our localization Dynamics 365 Business Central Ecuador version, is the complement of the standard basic functionality of Dynamics 365 Business Central with developments and functionalities that allow to comply with specific laws and regulations that are not covered within the standard solution.

We developed a complete solution to meet the required standards in Ecuador certified by Microsoft which will allow:

Electronic invoicing:

- Invoices.

- Credit/debit notes.

- Guides of remission.

- Withholdings.

- Withholding voucher.

- Purchase liquidation: purchases made to suppliers without RUC, it is made with the data of the company.

- Sales and transfer remission guides: these documents support the transfer of goods within the national territory, therefore all transportation must carry them.

Configuration of supplier masters:

-

- Payment methods.

- Type of supplier.

- Country of residence.

- Type of tax regime: Tax haven (displays a field where you must indicate the country where the tax haven is located.

- Tax haven.

- Related party: Yes or no field (Direct participation on the company can have the same capital or be shared. Indirect participation when more than 50% of the inventory is purchased from you.

- Type of identification.

Customers:

- Payment methods.

- Type of supplier.

- Type of identification.

- Establishment control.

- Identification of the informant.

- Taxes and withholdings.

- VAT calculations.

- Withholding calculations.

- ICE calculation: it is calculated on the base plus VAT.

Español

Español

LLB Solutions is a leader in providing robust software, web development and ERP & CRM business solutions. We create experiences and transformations.

LLB Solutions is a leader in providing robust software, web development and ERP & CRM business solutions. We create experiences and transformations.