At LLB Solutions, we’ve developed specialized localizations for Microsoft Dynamics 365 Business Central across Latin America to ensure full compliance with each country’s legal, tax, and accounting standards.

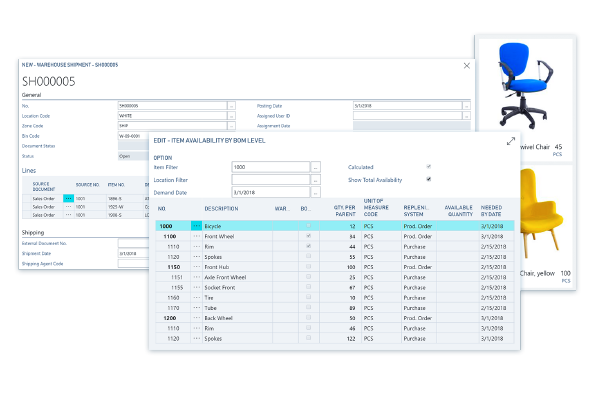

Our Nicaragua localization enhances the standard Business Central platform with powerful features built to meet DGI (Dirección General de Ingresos) requirements, including detailed tax information and local reporting needs.

Seamlessly integrated with local fiscal standards, this solution ensures accurate compliance, minimizes risk, and supports smooth operations across your fiscal processes in Nicaragua.

Our certified localization for Microsoft Dynamics 365 Business Central in Nicaragua is now available on Microsoft AppSource—giving your business everything it needs to operate with confidence.

- Stay compliant with all accounting, tax, and legal reporting requirements.

- Generate accurate fiscal reports, right when you need them.

- Get expert guidance for functional setup and configuration.

- Empower your team with comprehensive training.

- Streamline your data migration with localization-ready support.

Español

Español

LLB Solutions is a leader in providing robust software, web development and ERP & CRM business solutions. We create experiences and transformations.

LLB Solutions is a leader in providing robust software, web development and ERP & CRM business solutions. We create experiences and transformations.