The Chilean Internal Revenue Service (SII) has officially published new XSD schemas for electronic invoicing — both taxable and exempt — along with Technical Annex version 2.5, within the framework of Exempt Resolution No. 154 dated November 5, 2025. These updates introduce relevant adjustments to the structure of Electronic Tax Documents (DTE) and include specific […]

Author Archives: llbsadmin

On February 12, 2026, the Mexican Tax Administration Service (SAT) announced an update to the catalogs of the Digital Tax Receipt (CFDI) version 4.0, a relevant change for companies issuing electronic invoices in Mexico. These types of adjustments are part of the ongoing maintenance and improvement process of the CFDI standard, whose objective is to […]

The regulatory framework for the Electronic Waybill (Carta de Porte) continues to evolve to simplify processes and strengthen control across the agribusiness supply chain. Joint General Resolution No. 5821/2026 introduces amendments to the regulations previously established by Joint General Resolution No. 5017/2021, directly impacting producers and operators in the sector. Below, we outline the main […]

The SUNAT (National Superintendence of Customs and Tax Administration) has published an update to the Validation Rules for Electronic Payment Receipts (CPE), introducing adjustments to validations, removal of certain controls, and changes in tolerances mainly related to VAT (IGV) and product coding. These modifications aim to improve the consistency of electronic information and align it […]

The General Tax Directorate (DGI) of Uruguay announced that, starting March 3, 2026, it will begin rejecting all Electronic Tax Receipts (CFE) that are not aligned with the technical specifications v25/v25.1. This measure applies to most taxpayers, with the exception of Remittance issuers. What does this change mean for CFE issuers? Receipts that include information […]

SUNAT has published Superintendence Resolution No. 000005-2026-SUNAT/70000 in Peru’s Official Gazette, extending the period during which no penalties will be applied in connection with the use of the Integrated Electronic Records System (SIRE). This measure aims to provide taxpayers with greater flexibility to adapt their accounting processes and ensure the correct generation of the Electronic […]

Fiscal policy in Colombia continues to move toward tighter control over ultra-processed products. For 2026, the Colombian National Tax and Customs Authority (DIAN) updated the rates for the Tax on Sugar-Sweetened Ultra-Processed Beverages (IBUA) and reaffirmed the conditions of the Tax on Industrialized Ultra-Processed Foods (ICUI). These changes directly affect profitability, pricing strategies, and tax […]

Complying with tax regulations in Costa Rica is one of the biggest headaches for companies operating with Microsoft Dynamics 365 Business Central without a proper localization. Regulatory changes, validations from the Ministry of Finance, manual reprocessing, and errors in electronic invoices can quickly become a barrier to business growth. The good news? This problem has […]

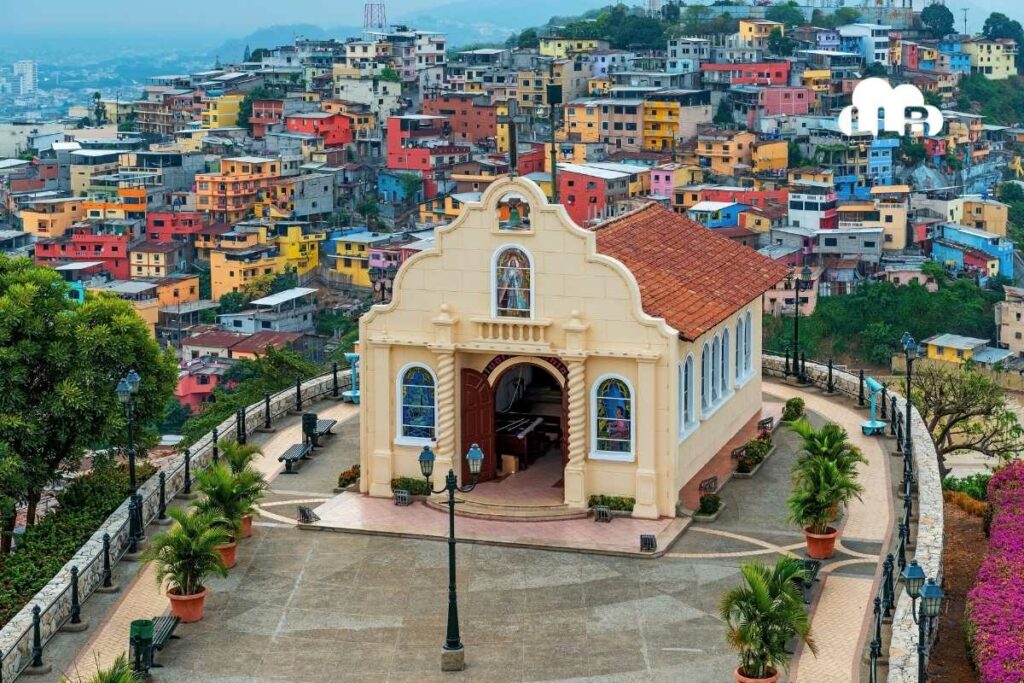

The Ecuadorian Internal Revenue Service (SRI) has published Resolution No. NAC-DGERCGC26-00000003, which updates the Income Tax self-withholding percentages applicable to Large Taxpayers, effective as of January 2026. This update is particularly relevant for companies included in the new official list, as it directly impacts monthly tax settlements, financial planning, and tax compliance. Who does this […]

Mexico’s Tax Administration Service (SAT) announced that on January 29, 2026, an update was made to the CFDI version 4.0 catalogues, which will take effect as of January 30, 2026. This update is relevant for companies that issue Digital Tax Receipts via the Internet (CFDI), as it directly impacts the validation of certain data used […]

Español

Español