We continuously monitor regulatory changes in each country and automatically apply them to our localizations, ensuring your business is always up to date and fully compliant with all regulations.

Agile and Scalable Implementations

Deploy in just 3 to 6 weeks with our proven agile methodology that ensures immediate tax compliance. Designed to power multinational operations, manage multiple entities, and support your regional expansion with our LATAM Localization.

contact us

Presence and Experience Across Latin America

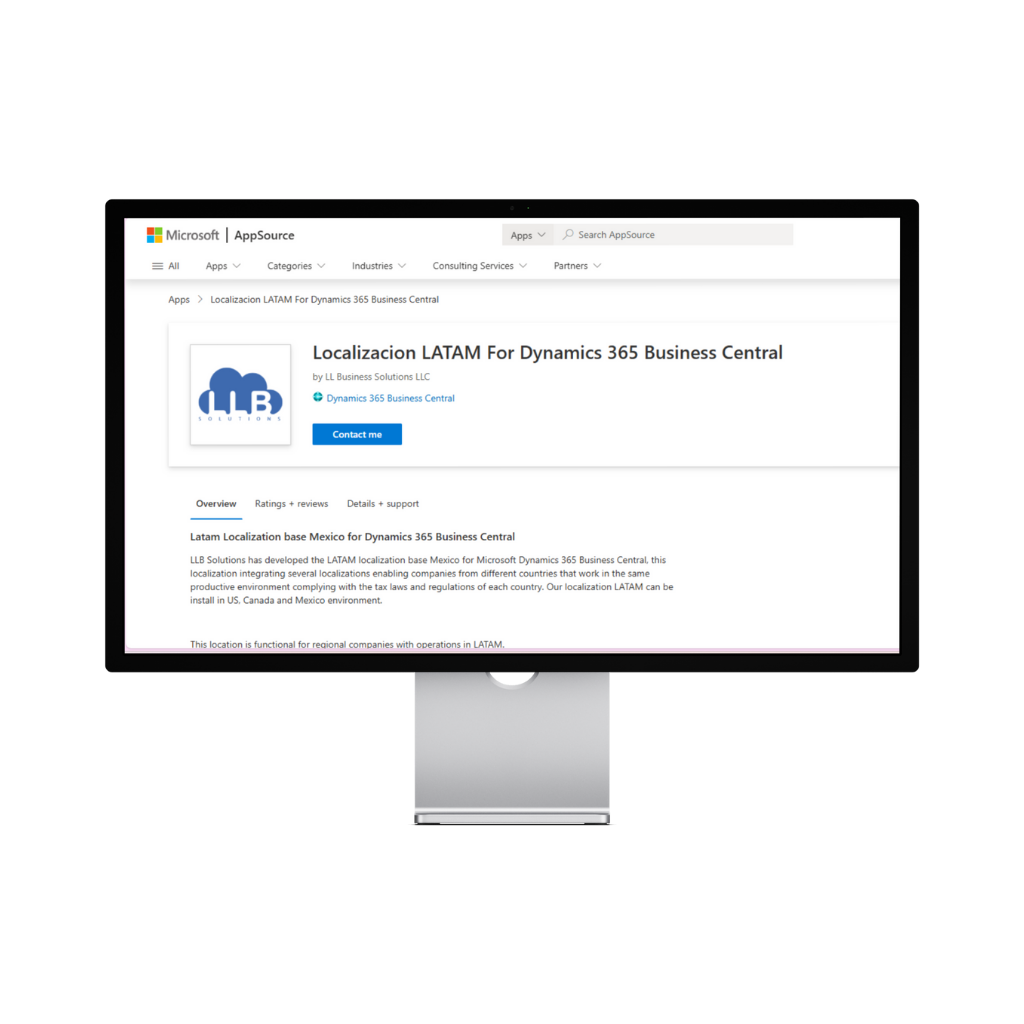

Our localizations are available for over 16 countries across Latin America, ensuring specialized support and tax compliance in every project. With more than 300 successful implementations and Microsoft AppSource-certified solutions, we support companies across multiple industries.

View Available Countries

Comply with Tax Regulations Simply and Securely

Certified Fiscal Localizations for LATAM

We adapt Microsoft Dynamics 365 Business Central to the tax, accounting, and regulatory requirements of more than 16 countries in Latin America.

LLB Solutions is a leader in delivering robust solutions for Dynamics 365 Business Central. We create experiences and drive transformation.

LLB Solutions is a leader in delivering robust solutions for Dynamics 365 Business Central. We create experiences and drive transformation.

Español

Español