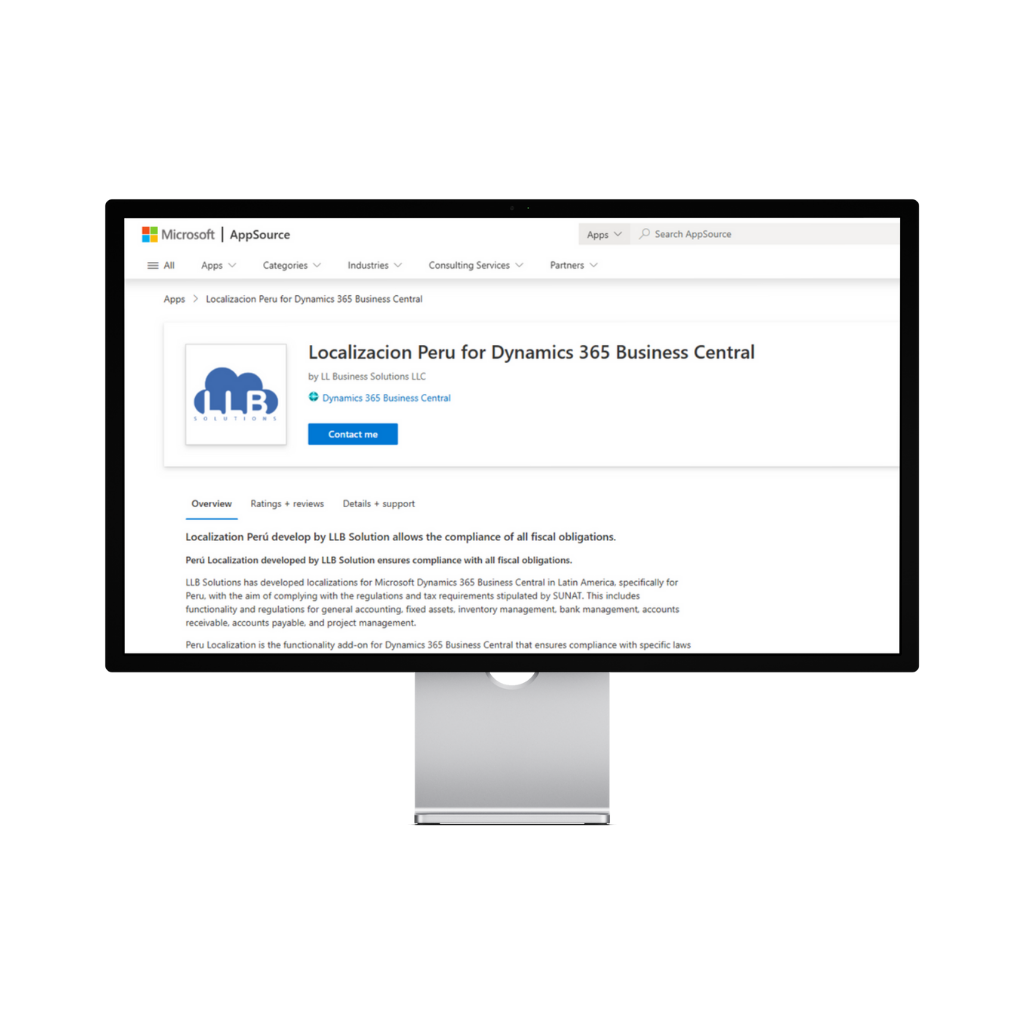

t LLB Solutions, we’ve developed specialized localizations for Microsoft Dynamics 365 Business Central across Latin America to ensure full compliance with each country’s legal, tax, and accounting standards.

Our Peru localization enhances the standard Business Central platform with powerful features built to meet SUNAT (Superintendencia Nacional de Administración Tributaria) requirements, including electronic invoicing and detailed tax information.

Seamlessly integrated with certified PACs, this solution ensures accurate compliance, minimizes risk, and supports smooth operations across your fiscal processes in Peru.

Español

Español

LLB Solutions is a leader in delivering robust solutions for Dynamics 365 Business Central. We create experiences and drive transformation.

LLB Solutions is a leader in delivering robust solutions for Dynamics 365 Business Central. We create experiences and drive transformation.